This is your introduction to GR/IR – no we’re not sending GR/IR to Room 101!

Every ERP system will have its version of GR/IR, by which I mean a system to account for purchasing activity on an accruals basis. (Did you spot those keywords? That’s why, here at TSA, we love GR/IR… ok, just me then…)

When you use purchase ordering, you will have a process to recognise delivery (the goods receipt, or GR) and a process to record invoices (the invoice receipt, or IR). This helps the business ensure that invoices are not paid without a confirmation that the related goods have been received.

Accounting

The GR/IR process is very useful for accounting. At the point of GR, we want to recognise the cost in the P&L, so the ERP system automatically posts a cost using the quantity of goods marked as received. The opposite entry is in the GR/IR control account on the balance sheet, representing an ‘automatic accrual’ of the cost we’ve yet to be invoiced for.

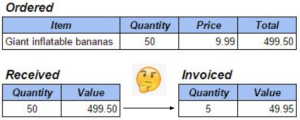

When the invoice arrives for the order, it matches the goods receipt to clear the accrual on the GR/IR control account. It’s important to note that the GR/IR match occurs on quantities, not values. If you receive and are invoiced for the same quantity, the GR/IR balance is cleared.

When you receive and are invoiced for the exact quantity ordered at the exact unit price expected, everything balances wonderfully.

But what about when things don’t turn out as expected?

Handling of quantity mismatches

If your supplier invoices for a lower quantity than you’ve goods receipted, nothing happens as the system will happily pay for less than you received.

If your supplier invoices for a lower quantity than you’ve goods receipted, nothing happens as the system will happily pay for less than you received.

The uninvoiced quantity remains as an accrual on the GR/IR. There’s often no feedback to the user that there is a difference. It’s up to you to look at outstanding orders and decide what to do in this situation. Your ERP system might give you some handy reports. It’s important to look at these reports, as if you’ve GR’d too much you’ve put false cost into the P&L.

But if the supplier invoices for a higher quantity than you GR’d, the invoice won’t pay until you GR the extra quantity. After all, you don’t want the system paying for all that quantity if you really didn’t receive it. In this scenario the ERP system should tell you that the supplier invoice is blocked for payment. Some ERP systems will tell the supplier too (whoops, embarrassing!). So who’s right and who’s wrong?

But if the supplier invoices for a higher quantity than you GR’d, the invoice won’t pay until you GR the extra quantity. After all, you don’t want the system paying for all that quantity if you really didn’t receive it. In this scenario the ERP system should tell you that the supplier invoice is blocked for payment. Some ERP systems will tell the supplier too (whoops, embarrassing!). So who’s right and who’s wrong?

- If you’re wrong, you need to GR quickly so that the supplier can be paid for what they’ve delivered. Hopefully the approved purchase order quantity hasn’t been exceeded, but this does happen sometimes and means you’ll need to get your order re-approved for the higher quantity before you can GR and clear the invoice.

- If the supplier is wrong, you need them to credit the quantity not supplied. This will then allow the quantity match to complete so that the net amount can be paid.

Handling of price mismatches

When the unit price you put on your order is not the unit price on the invoice, there is a financial imbalance that the system needs to deal with. The only thing to do is put the difference to the P&L. This is correct, because it recognises that while you thought the price would be X, it turned out to be Y and as you’ve received the goods you have to take the actual cost of Y and not what you wanted it to cost (X).

If the unit price is less, there’s nothing you need to do (except perhaps use the lower price next time you place an order – maybe after checking the invoice for clarification – did you get a quantity discount?).

If the unit price is less, there’s nothing you need to do (except perhaps use the lower price next time you place an order – maybe after checking the invoice for clarification – did you get a quantity discount?).

But when the unit price is more, the system won’t allow the invoice to pay because you haven’t approved the higher price. It should notify you (and possibly the supplier) about the problem. So who’s right and who’s wrong?

But when the unit price is more, the system won’t allow the invoice to pay because you haven’t approved the higher price. It should notify you (and possibly the supplier) about the problem. So who’s right and who’s wrong?

- If you’re right, you need to make sure the supplier sends you a credit for the price difference. This will lead to a net amount that the system is happy to pay.

- If the supplier is right, you need to get your order re-approved with the higher unit price. The system will recognise this approval and allow the invoice to be paid.

Notice how, with a price mismatch, you don’t do any goods receipting as the quantities are fine.

Note: accounting for price mismatches

In SAP at least, you get an immediate hit in the P&L once the invoice price is known. If the invoice hasn’t been processed when you do your GR, the automatic accrual only has the price from the order, so will use that. When the invoice is processed, the price difference adds to (or subtracts from) the P&L accrual.

However note that if the invoice is processed before you do your GR, the system will use the actual price on the invoice to value your GR. Of course that doesn’t mean that the invoice won’t be blocked for payment.

However note that if the invoice is processed before you do your GR, the system will use the actual price on the invoice to value your GR. Of course that doesn’t mean that the invoice won’t be blocked for payment.

Budget managers may not be happy to see unapproved higher prices in their budget reports. In the normal course of events though it is somewhat motivational!

What goes wrong?

- Accidentally goods receipting the entire order because the system suggests it (naughty system). You can end up paying for goods you haven’t received if the supplier invoices incorrectly/too soon.

- Reversing a GR after the invoice has already been processed and paid. Too many happy people…

- the budget manager is happy because cost has been removed.

- the supplier is happy because he got paid and no one has asked him to refund.

- the accountant goes berserk!!!

My ideal GR/IR process…

Excuse me while I go all misty-eyed thinking of my wish list for a fab GR/IR process in an ERP system:

- Don’t suggest what I’ve received when I go to GR – not the balance of the order, and not even the amount of the last invoice. It’s too easy for even for best of us to say “ok, whatever.”

- Don’t let me forget about orders that have problems or are just generally unresolved. Be smart about it and rank items by priority or group by type of issue:

- An overdue blocked invoice is more important than one that isn’t due for two weeks.

- Issues that require the order to be reauthorised need the time and co-operation of the authoriser.

- The age of the GR/IR balance should be a red flag too – if you did your GR 6 months back and there’s still no invoice, you might be looking at a duplicate order.

- Do tell me when something happens (that I didn’t do) which leaves the GR/IR out of balance. That means telling me when an invoice is processed that doesn’t match my GR – not just when the GR isn’t enough.

- Do let me reverse a GR that has already been invoice-matched but stop the invoice from being paid (if not too late!) and tell the supplier a credit note is now required.

- Do tell the supplier every time their invoice is not immediately free for payment. I’d rather be chased by a few suppliers based on that information than be chased by a lot of suppliers based on no information.

- Do tell the supplier that their invoice is ok. I’m thinking of supplier portals here. Suppliers will more happily use a portal if it gives them useful information, and they won’t be phoning me to check if I’m going to bother paying them.

We’ve been answering questions about GR/IR for years, so feel free to ask yours in the comments.

Pingback: What is a Systems Accountant? | The Systems Accountant